- The Daily Yield

- Posts

- 🌾 Grains wobble, trades rumble

🌾 Grains wobble, trades rumble

Trade tensions rattle grains; wheat and corn take an unexpected tumble. Machine sales are down. Plus we touch on sulfur apps in early soybeans.

👋 Well, here we are—another day, another round of world leaders making headlines. Trump’s continues efforts to reduce the federal bureaucracy by targeting specific agencies for staffing cuts, and Canada’s got a new guy at the helm.

— TDY team

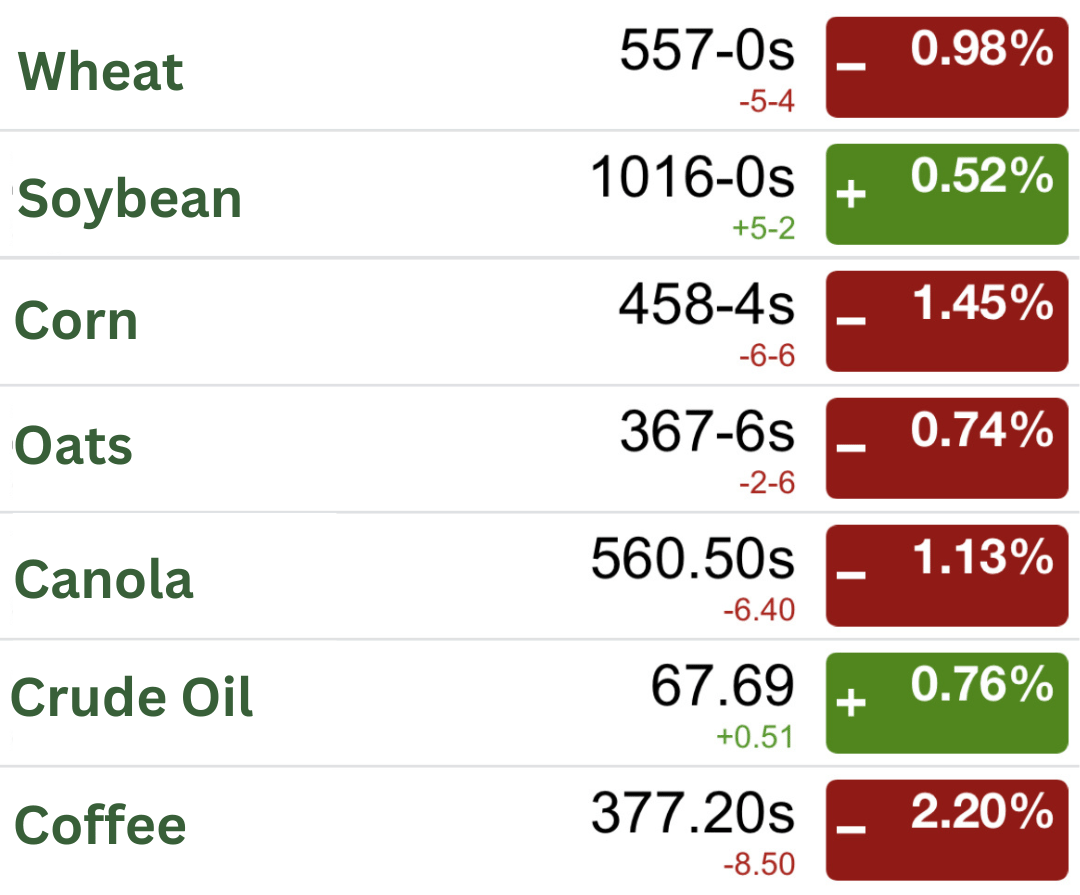

Market pulse

Grains face pressure, oil rebounds

Data provided by: Barchart.com

As of: Market close 03/14/2025

The grain markets had a choppy week, with wheat and corn taking a dive, while soybeans held firm, and canola stayed relatively stable. Trade tensions, shaky export demand, and unpredictable weather patterns continue to impact movement on all commodities.

The soybean market experienced a slight decline, with prices falling 0.9% to $10.16 per bushel by the end of the week. This downturn is attributed to escalating trade tensions, particularly China's imposition of additional tariffs of up to 15% on major U.S. agricultural products, including soybeans, effective March 10. These measures have disrupted trade flows, leading to concerns over reduced U.S. soybean exports.

Corn futures also faced pressure, inching lower and setting the stage for weekly losses. The market has been weighed down by abundant South American supplies and apprehensions about trade conflicts disrupting export demand. On the other hand, Wheat prices eased during the week; however, the market is poised for a weekly gain amid expectations of lower exports from Russia. This potential reduction in Russian wheat exports has provided some support to global wheat prices.

The overarching theme affecting grain markets this week has been the escalation of trade tensions. China's retaliatory measures, including suspending soybean import licenses for three major U.S. companies and halting U.S. log imports, have added uncertainty to the market. Additionally, the anticipation of record Chinese soybean imports in the second quarter may ease current supply tightness but also adds complexity to global supply dynamics.

Agribusiness

Tractor, combine sales take a nosedive in February

abcnetwork on Giphy

February was a tough month for tractor and combine sales, with numbers plummeting faster than a greased pig on a slip 'n slide. According to the Association of Equipment Manufacturers (AEM), U.S. sales of agricultural tractors dropped 17.7% compared to the same month last year.

Two-Wheel Drive Tractors:

Under 40 horsepower: 7,908 units sold (down 18%)

40–99 horsepower: 3,413 units sold (down 13%)

100+ horsepower: 1,568 units sold (down 22%)

Four-Wheel Drive Tractors:

Sales plunged 41% to 226 units

Combines:

Sales nosedived 48% to 354 units

Curt Blades, AEM’s senior vice president, commented on the situation, saying, "While the recent decline in agricultural tractor and combine sales reflect current market challenges, including global trade concerns and tariffs, we continue to remain optimistic about the long-term future of agricultural equipment."

In other words, they're hoping this downturn is just a temporary blip.

Deere & Co., the big kahuna of farm equipment, reported a 35% drop in quarterly revenue, missing analysts' expectations. Farmers are tightening their belts, opting to rent equipment due to weak incomes and high borrowing costs. This news caused Deere's shares to drop by nearly 4.5% in premarket trading.

Global trade tensions, tariffs, and high interest rates are making farmers more cautious than a cat in a room full of rocking chairs. Both equipment manufacturers and farmers are holding their breath, hoping for sunnier days ahead.

In the meantime, it might be a good idea to hold off on that new tractor purchase and make do with the old reliable one—just slap on some duct tape and keep on plowing.

Policy

Canada resumes imports from Smithfield's Tar Heel pork plant

In early March 2025, Canada's food inspectors hit the pause button on imports from Smithfield Foods' Tar Heel facility in North Carolina—the largest pork-processing plant in the U.S. The reason? A hiccup involving offal shipments (that's organ meat for the uninitiated). This week-long intermission, from March 6 to March 12, had both sides scrambling to get back on track.

After swift coordination between the U.S. Department of Agriculture and the Canadian Food Inspection Agency, the suspension was lifted on March 12. Pork products from the Tar Heel plant are now rolling northward again, much to the relief of producers and consumers alike.

This incident unfolded against a backdrop of escalating trade tensions. Recent U.S. tariffs on imports from Canada, Mexico, and China have sparked concerns about retaliatory measures affecting agricultural exports. Farmers fear that such disputes could shrink their markets and squeeze profits.

Smithfield Foods' CEO, Shane Smith, acknowledged that tariffs complicate the pork business, especially when it comes to selling various pig parts not commonly consumed in the U.S. Despite these challenges, Smithfield remains committed to navigating the complex trade landscape to maintain its export markets.

While the swift resolution of the import suspension is a positive sign, looking ahead the agricultural sector remains vigilant. Ongoing trade negotiations and potential policy shifts could impact market dynamics. Producers and exporters best be keeping a close eye on developments to ensure their ability to adapt and thrive in this rather unpredictable environment.

Agronomy

The secret sauce for early-planted soybeans?

Soybeans, much like that one friend who insists on wearing shorts in April, do best when they get a head start on the season. Early planting means a longer growing season, bigger yields, and a happier farmer. But if you’re throwing those seeds into cool, wet soils without thinking about sulfur, you might be setting your crop up for disappointment.

Sulfur is like the unsung hero of soybean growth—it helps with nitrogen fixation, nodule formation, and protein content. Soybeans usually scavenge it from organic matter in the soil, but when the ground is cold and microbial activity is sluggish (like a teenager waking up before noon), that sulfur just isn’t available.

"When the soil is cooler, mineralization of microbial activity is limited, so there is an opportunity to bolster it with a soluble source of sulfur"

In other words, your soybeans need a little breakfast boost, and sulfur is the morning coffee that gets them going.

So, what’s the sulfur strategy? Ammonium sulfate (AMS)—the go-to granulated product for early-season sulfur needs. Casteel recommends spreading 15-25 pounds per acre, with 20 pounds being the Goldilocks zone. Not too much, not too little—just right.

And while sandy, loamy soils are the usual suspects for sulfur deficiency, even richer soils (up to 4% organic matter) can benefit from a little extra sulfur when soybeans go in early. Over five years of research, Casteel has seen yield bumps of 8-10 bushels per acre (bpa), with some lucky spots hitting a 20-bpa increase. Not bad for adding a little sulfur, right?

Of course, no magic formula works every time. Translation: Farming is a game of trial and error, so test it out in strip trials before going all in.

Sulfur isn’t the only early-season hurdle. Before you start hauling in AMS by the truckload, remember—low soil pH can also mess with nitrogen fixation. If your soil pH is out of whack, your soybeans might struggle no matter how much sulfur you throw at them.

Ag-bite bulletin

👩💼 U.S. Secretary of Agriculture's Initiatives: In her first month, Secretary Brooke Rollins has focused on enhancing efficiency and promoting agricultural prosperity, reflecting the USDA's commitment to supporting farmers and rural communities.

💉 RFK Jr. cautions against poultry vaccination: Health and Human Services Secretary Robert F. Kennedy Jr. advises against vaccinating poultry amid an avian flu outbreak.

🍁 Canadian grocers prioritize local: Promoting "made in Canada" products and reducing reliance on U.S. goods.

Number of interest

$6 billion

That’s how much moolah the Canadian government has announced for financial aid to support businesses affected by U.S. tariffs. The aid aims to help companies diversify into new markets, cushion losses, provide easy loans, and prevent layoffs. This move underscores Canada's efforts to reduce dependency on U.S. trade and bolster its agricultural sector amid escalating trade tensions.

Help us out!

Don’t keep it to yourself: Share our newsletter with a friend or colleague.

The more we grow, the better we can serve you! 📈

Tractor thoughts

People without teeth can close their mouths further… source

Reply