- The Daily Yield

- Posts

- 😰 Not the whiskey...

😰 Not the whiskey...

Currency woes and trade shifts: Why U.S. pork exports are sizzling down this week

🍰 Happy Pi Day! Today is celebrated as Pi Day, a celebration of the mathematical constant pi (π). It is also Albert Einstein’s birthday (the man who gave us E=mc²). Born in 1879, 146 years ago today.

— TDY team

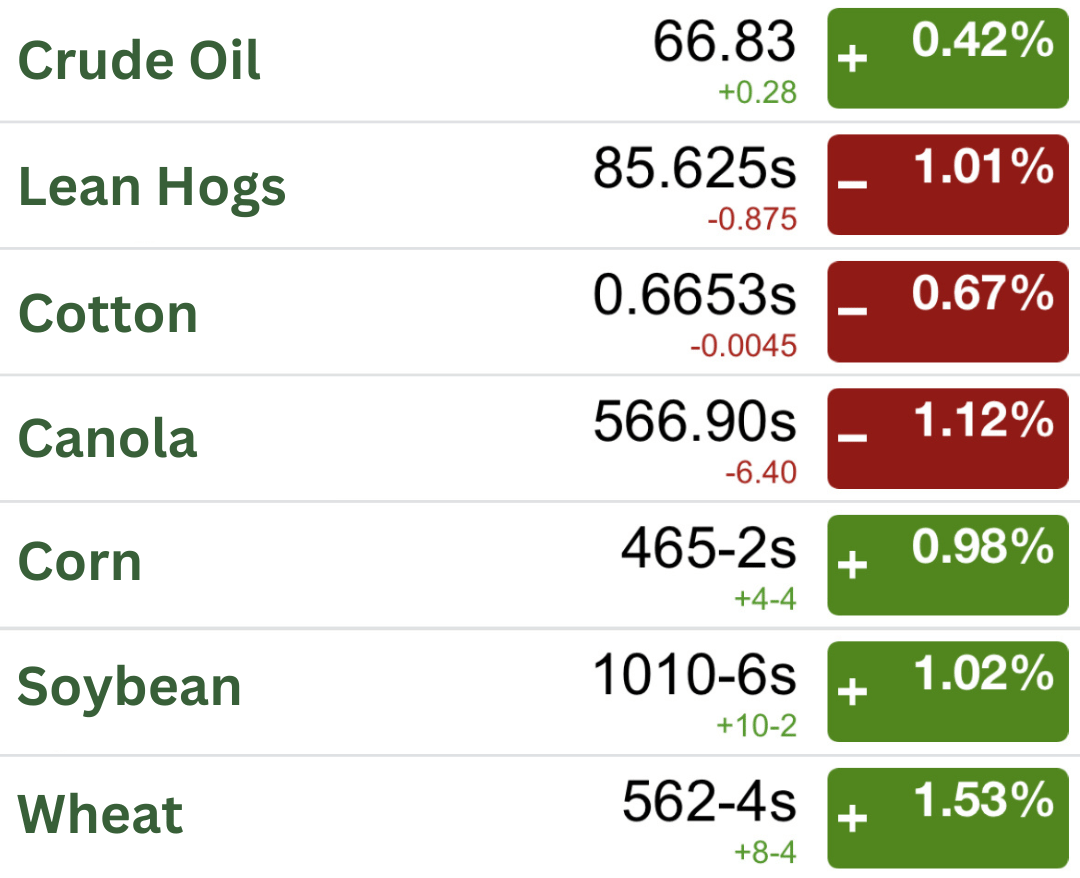

Market pulse

Pork export sales hit a slump—who stole the bacon?

Data provided by Barchart.com

It seems the beloved U.S. pork market has hit a bit of a rough patch. According to the latest USDA reports, pork export sales have dropped to a marketing-year low, with net sales of just 20,300 metric tons—a 52% nosedive from the previous week and 35% below the prior four-week average. Several factors are at play:

Currency conundrums: The value of the U.S. dollar can make American pork more expensive for foreign buyers, leading them to seek cheaper alternatives elsewhere.

Seasonal slumps: Certain times of the year naturally see reduced demand for pork products, and we might just be in one of those lulls.

Geopolitical juggling: Trade tensions and tariff tussles can make international buyers hesitant, impacting overall demand.

But it’s not all doom and gloom. While sales are down, exports have actually seen a slight uptick. The USDA notes that exports of 33,600 metric tons were up 4% from the previous week and 5% from the prior four-week average, with Mexico, South Korea, Japan, Colombia, and China being the primary destinations.

Business

Beck’s Hybrids expands seed empire with strategic facility acquisitions

Beck's Hybrids has announced its acquisition of Gro Alliance's corn seed production facility in Howe, Indiana, along with soybean seed production and corn drying facilities in Mount Pulaski, Illinois. This strategic expansion aims to bolster Beck's seed production capabilities and enhance its supply chain efficiency.

Why this is an important step for Beck’s:

Increased production capacity: The acquisition of these facilities is set to significantly boost Beck's ability to produce and process corn and soybean seeds, meeting the growing demands of farmers across the region.

Strategic locations: With facilities in Indiana and Illinois, Beck's is positioning itself to better serve key agricultural markets, reducing transportation times and costs.

Supply chain efficiency: Integrating these new assets is expected to streamline Beck's operations, ensuring a more reliable and efficient seed supply chain.

This acquisition aligns with Beck's ongoing strategy of growth and expansion. In recent years, the company has made several strategic moves, including expanding research operations with the acquisition of a Nebraska facility. These efforts underscore Beck's commitment to innovation and meeting the evolving needs of farmers nationwide.

Beck's latest acquisition marks a significant step in strengthening its seed production capabilities. By securing these new assets, the company is not only enhancing its operational efficiency but also reinforcing its dedication to providing high-quality seeds to farmers. As the agricultural landscape continues to evolve, Beck's proactive approach ensures it remains at the forefront of the industry, ready to meet the challenges and opportunities that lie ahead.

Policy

More trade war chaos: Whisky, tariffs, and market jitters

Looks like the global trade playground just got a little rowdier. Former President Donald Trump has thrown down the gauntlet, threatening a 200% tariff on EU alcoholic beverages—because nothing says negotiation tactics like making Europeans pay triple for their favorite bourbon. The demand? The EU better drop its 50% tariff on American whisky or prepare for a tariff-fueled hangover.

The markets did not take the news well. Germany’s DAX dropped 0.86%, France’s CAC 40 slipped 0.4%, and over in the U.S., the Dow Jones opened 70 points lower—because, apparently, Wall Street also likes its whisky cheap. Meanwhile, the UK’s FTSE 100 wobbled like a tipsy pub patron, staying slightly in the green while the rest of Europe stumbled.

And if that wasn’t enough drama, UK automakers are begging for subsidies to keep their EV industry from flatlining, while furniture retailer DFS is somehow doing great (because, hey, if the economy’s tanking, might as well get a comfy couch to sit through it). Even model train maker Hornby is jumping off the AIM stock exchange to save cash—because, let’s be honest, this isn’t exactly a bull market for toy locomotives.

But wait—there’s more! Trump also set his sights on Ireland, accusing the country of “stealing” U.S. pharmaceutical companies (probably through their incredibly suspicious low corporate tax rates). Meanwhile, the UK housing market is crawling to a halt, as stamp duty changes and economic jitters keep buyers on the sidelines.

In summary: Trade tensions are high, whisky prices might skyrocket, and even toy trains are feeling the heat. Cheers to global economics!

AgTech

Case IH’s smart downforce: Because your planter deserves a brain

Ever feel like your planter’s just winging it when it comes to seed placement? Enter Case IH’s Smart Downforce—the system that ensures your planter applies just the right amount of pressure, making sure each seed is snug as a bug in a rug. No more seeds tossed around like confetti at a parade; this tech promises precision.

At the heart of this system are electric dampers, adjusting in real-time to varying field conditions. Think of them as the shock absorbers for your planter, ensuring a smooth ride for your seeds. Whether your field’s as smooth as a pancake or as bumpy as a teenager’s love life, these dampers adapt to maintain optimal seed-to-soil contact.

What’s the big idea?

Inconsistent downforce can lead to uneven planting depths, resulting in poor germination and reduced yields. By maintaining consistent pressure, Smart Downforce helps ensure uniform emergence, leading to healthier crops and potentially higher profits. It’s like giving your planter a sixth sense—one that pays dividends come harvest time.

Ag-bite bulletin

🇦🇺 Australian food exports: On track to reach $100 billion annually, with recent figures hitting $75.6 billion. Free trade agreements have opened markets in India, South America, and ASEAN countries, boosting agricultural production value to an anticipated $88.4 billion in 2024-25.

💰 Federal relief falls short for farmers: The Canadian federal government has introduced relief measures for farmers, but experts argue they may not suffice to address the industry's pressing challenges.

🇨🇳 China's grain stockpiling surge: China has increased its 2025 grain production target to approximately 700 million metric tons and boosted its agriculture stockpile budget by 6.1%.

🧾 Minnesota farmland hits the auction block: Over 5,600 acres of Minnesota farmland are scheduled for auction in March 2025.

🚜 Tillage inspection checklist: Follow these tips to prepare for spring.

Don’t keep the good stuff to yourself: Share this newsletter!

The more we grow, the better we get. 📈

Tractor thoughts

It's crazy to think about how humanity has gone from foraging food in forests, going through trial and error with what's edible, all the way to 3 star Michelin cuisine. source

Reply