- The Daily Yield

- Posts

- 🥚 Oval drama

🥚 Oval drama

Bearish trends in today's report. Tractor shopping in 2025 & power in Canadian potash.

👋 Morning! Nothing like a little Oval Office chaos to kick off the week! Incase you live under a rock and missed the drama, the Oval Office turned into the world's most expensive family argument last week. Let’s skip the drama and get to the ag news that actually matters!

— TDY team

📉 Market pulse: Bearish trends & policy uncertainty

Presented by: The Daily Yield

Grain Market Recap – Feb 28, 2025

Corn and soybeans took a hit last week, with corn futures dropping 38 cents to $4.5350/bushel and soybeans sliding 28 cents to $10.1150/bushel. The biggest factors? USDA’s Ag Outlook Forum projections forecasting higher yields and ending stocks and Trump’s tariff announcement, which rattled trade expectations.

For corn, the USDA predicts 94 million planted acres and 181 bushels per acre yields, meaning more supply and pressure on prices. Export sales were weak, and while ethanol production held steady, rising stocks kept prices down. Meanwhile, soybeans remain range-bound as crush demand stays strong, but policy uncertainty around biofuels and strong South American harvests are limiting U.S. export potential.

Bottom line? The grain market leans bearish due to big supply, weak exports, and geopolitical uncertainty. Farmers should watch ethanol and crush demand, while investors should track USDA’s next WASDE report and potential policy shifts. Cost control is key for growers, while investors should stay sharp on macroeconomic moves.

🚜 Business: Navigating the 2025 market

Getty Images

In recent years, both new and used tractor prices have experienced significant fluctuations, influenced by a combination of supply chain disruptions, economic pressures, and evolving market dynamics. Here's a breakdown of the factors contributing to these trends and what they mean for farmers and equipment buyers in 2025.

Supply chain disruptions during the COVID-19 pandemic caused shortages of components like semiconductors, reducing new tractor production and increasing prices. As supply chains recovered, manufacturers increased production, resulting in a surplus of new and used machinery on dealer lots, affecting pricing. Rising interest rates have made financing new equipment more expensive, causing farmers to delay purchases and impacting the used equipment market, leading to inventory accumulation.

Shifts in demand and market saturation

As new equipment became more expensive and less accessible, demand for used machinery initially surged. However, with the current surplus of both new and used equipment, prices have started to stabilize, and in some cases, decline. This shift has created a buyer's market, offering opportunities for those looking to invest in machinery. Yet, the abundance of options has also led to decision paralysis among buyers, contributing to slower sales and further inventory buildup.

Looking ahead: Strategies for farmers

Given the current market conditions, farmers and equipment buyers should consider the following strategies:

Evaluate Financing Options: With rising interest rates, exploring alternative financing solutions or negotiating better terms can help mitigate costs.

Assess Equipment Needs: Carefully assess operational requirements to determine whether investing in new machinery is necessary or if existing equipment can be optimized.

Monitor Market Trends: Stay informed about market dynamics to identify optimal purchasing times and capitalize on favorable pricing.

By understanding the factors influencing tractor prices and adopting strategic approaches, you can navigate the 2025 equipment market more effectively, ensuring your operation remains both efficient and financially sustainable.

🏛️ Policy: Canada’s potash power

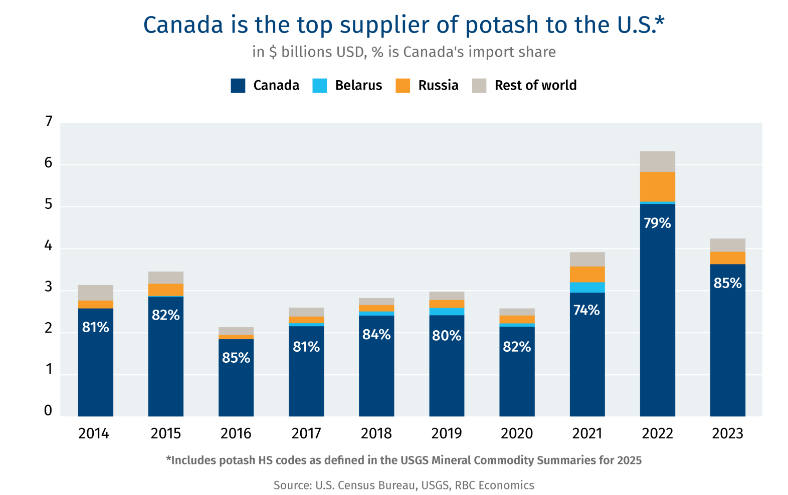

Canadian potash has long been the unsung hero of American agriculture, quietly fueling crop production across the Midwest. But now, it’s caught in the crossfire of U.S. trade policy.

The U.S. heavily depends on Canadian potash, with over 80% of its supply coming from north of the border. Essential for soil fertility and crop yields, potash is a non-negotiable input for American farmers growing everything from corn to soybeans. But with proposed 25% tariffs, prices could jump by $100 per ton, adding $1.70 per acre for corn and $1.42 per acre for soybeans, a crushing blow to farmers already battling tight margins.

Industry leaders are sounding the alarm.

Nutrien Ltd. warns these tariffs will hurt U.S. farmers far more than Canada, while The Fertilizer Institute is pushing for an exemption, citing that 95% of U.S. potash demand relies on imports, with Canada supplying 90%. The fallout wouldn’t stop at the farm gate. With inflation still a concern, this tariff could drive up costs from field to fork.

Businesses are making a strong case for keeping Canadian potash tariff-free, emphasizing the risks to both U.S. agriculture and the broader economy. But if the administration pushes forward, farmers will be forced to make tough choices, either absorb the higher costs or cut back on fertilizer use, which could hurt yields and, ultimately, production.

📢 Ag-bite bulletin:

Eggs-tra! Eggs-tra! Prices set to soar 41% amid bird flu flap: Hold onto your omelets, folks! The USDA just hatched a forecast predicting egg prices will scramble up 41% this year, thanks to a relentless bird flu that's got our feathered friends feeling fowl. With nearly 19 million hens culled by January, it's no yolk that your breakfast staple is becoming a luxury item. Meanwhile, egg producers are raking in the dough, with Cal-Maine Foods reporting an 82% revenue spike.

Dirt's got a new trick up its sleeve: UK researchers have stumbled upon a secret handshake between plant roots and soil microbes, and it's a game-changer. This underground gossip session could mean plants will need less of those nitrate and phosphate cocktails we've been serving them. Imagine farming where the soil does the heavy lifting, and we just sit back and watch the magic happen. Sustainable farming, here we come, no fertilizer required, just a little microbial matchmaking!

Texas Rancher Killed by Suspected Cartel IED: A Texas rancher was tragically killed by a suspected cartel IED near the Mexican border. Authorities warn of a growing threat to those living and working along the border, urging increased caution.

Illinois farms are disappearing fast: Since 1982, over 23,000 family farms in the state have pulled a Houdini, vanishing into thin air. Why? Trade policies that seem to have a crush on big agricultural companies. Meanwhile, the U.S. is juggling a $39 billion agricultural trade deficit, leaving small farms scratching their heads and wondering if they should start growing money trees instead.

Don’t keep the good stuff to yourself!

Share this newsletter with fellow farmers, students, insiders, investors, and anyone who loves staying ahead of the curve.

The more we grow, the better we get!

🧠 Brain activator: Ag riddle

I have ears but cannot hear,

I stand tall but have no fear.

In golden waves, I dance and sway,

Feeding nations every day.

What am I?

The best way to predict the future is to grow it.

🤯 Answer: Corn!

Reply